Truthdig

When the Federal Reserve cut interest rates last week, commentators were asking why. According to official data, the economy was rebounding, unemployment was below 4% and gross domestic product growth was above 3%. If anything, by the Fed’s own reasoning, it should have been raising rates.

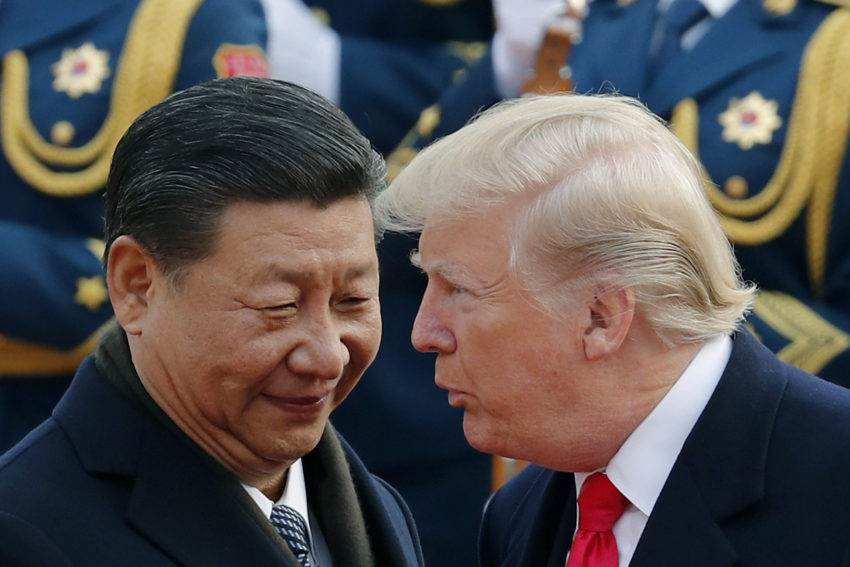

Market pundits explained that we’re in a trade war and a currency war. Other central banks were cutting their rates, and the Fed had to follow suit in order to prevent the dollar from becoming overvalued relative to other currencies. The theory is that a cheaper dollar will make American products more attractive in foreign markets, helping our manufacturing and labor bases.